-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael拥有超过35年的机构投资组合经理经验, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Satisfaction

Published: 08-07-2023为什么美联储坚持认为低失业率会推高通胀? 政策制定者的想象力被无用的信息激发了,他们就是得不到…….

And I’m tryin’ to make some girl, who tells me

Baby, better come back maybe next week

Can’t you see I’m on a losing streak?米克·贾格尔(Mick Jagger)已经很久没有连败了. 可悲的是,货币政策的执行者却并非如此.

In 1958, William Phillips, a New Zealand economist, 研究了1861-1957年英国失业率和工资之间的关系,得出了失业率下降和工资上涨之间存在相关性的结论, and vice versa. It became known as the Phillips Curve. Subsequently, Paul Samuelson and Robert Solow, two Nobel Laureates, linked wage gains with inflation, and thus the Phillips Curve became economic orthodoxy. 政策制定者现在可以自信地调整经济,通过接受略高的通胀来换取失业率的下降(更多的就业机会总是政治上的赢家)。.

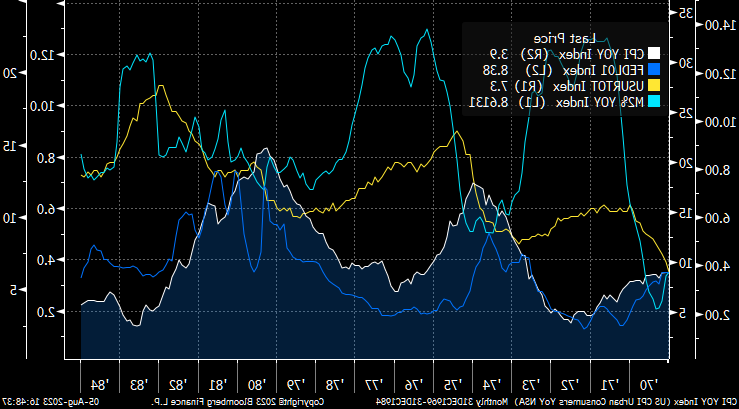

But a funny thing happened in the 1970s. Beginning in 1973, 通货膨胀率和失业率并没有像菲利普斯曲线所预测的那样偏离, but rose in tandem. In 1975, both data sets then fell together, and then in 1979 both rose again in lock-step, 在1983年和接下来40年的大部分时间里,这两个国家都走到了一起. The chart below shows the unemployment rate in yellow, inflation (CPI) in white, 深蓝色表示联邦基金利率,浅蓝色表示货币供给增长, between 1970 and 1984.

20世纪70年代的经历与菲利普斯曲线相矛盾:通胀和失业率并没有相反走向, they moved together. On hand with an explanation was Milton Friedman, another Nobel Laureate, 谁说通货膨胀“无论何时何地”都是一种货币现象, meaning that inflation reflected the price, or value, of money, 任何东西的价格都是由供给和需求曲线决定的. High inflation was caused by too much supply of money, as the chart above clearly shows (M2, the light blue line, 在20世纪70年代初和70年代中期都出现了激增). Cut off the supply of money and inflation will fall. 保罗•沃尔克(Paul Volker)在1980年正是这么做的,正如弗里德曼所说的那样,通胀下降了.

Following the Global Financial Crisis in 2009, 美联储将利率降至零,并维持了7年. The Fed began raising rates in 2016, but in 2019 a mild downturn in the economy (from 3% to 2%; you have to squint to see it below, the purple line) caused the Fed to start cutting rates again.

The Fed raised rates in 2016, 不是因为它认识到零利率会扭曲投资决策(事实确实如此), 而是因为美联储担心,在下一次经济衰退中,它将无法削减利率,因此它希望有一些缓冲来这么做. From 2009 through 2019, inflation averaged 1.7%, and the Fed felt that 1.7% inflation was too close to zero, and deflation, falling prices, would be difficult to manage with interest rates at zero.

It’s hard to describe just how misguided this thinking was. “最佳”通胀率是指不影响投资决策的通胀率. 通胀是对储蓄者/投资者征税,因此“最佳”通胀率为零. A rate of 1.7% is not too low, 然而,政策制定者对这一水平并不满意,因为他们担心通缩近在咫尺,令人不安.

2020年3月,新冠肺炎疫情爆发,全球经济陷入瘫痪. Households and businesses hoarded cash and the Fed, appropriately, met the demand for cash by supplying more of it. But as the economy re-opened, and the demand to hold cash diminished, yet the Fed continued to supply record amounts of money. 每年的货币供应量从未超过15%(回到严酷的20世纪70年代), 然而,美联储允许货币供应量在2020年和2021年分别增长20%以上(见下图)。. 正是这种货币的爆炸性增长导致了40年来最高的通货膨胀.

货币供应量的增长在2021年2月达到顶峰,自2022年12月以来一直在收缩,这是历史上第一次, probably since 1932). Inflation peaked in June 2022 (white line below) at 9.1% and has fallen to 3.5% in the past year. Inflation has fallen because money supply is contracting. Yet, the Fed just hiked the Fed funds rate to 5.5%; why?

Well, 显然,新的问题是失业率太低了,只有3.5%, pushing wages higher. 回到菲利普斯曲线:低失业率=工资上涨=通货膨胀上升. 因此,美联储认为,为了提高失业率,它必须保持高利率, lower wages and thereby lower inflation.

The Fed is not satisfied with falling inflation and 3.5% unemployment because the Phillips Curve model does not allow for low unemployment and low inflation; remember, 失业和通货膨胀被认为是相互对立的.

但正如我们在过去50年所看到的,通货膨胀是一种货币现象. It is a function of the supply of and the demand for money. Money supply is contracting and inflation is falling.

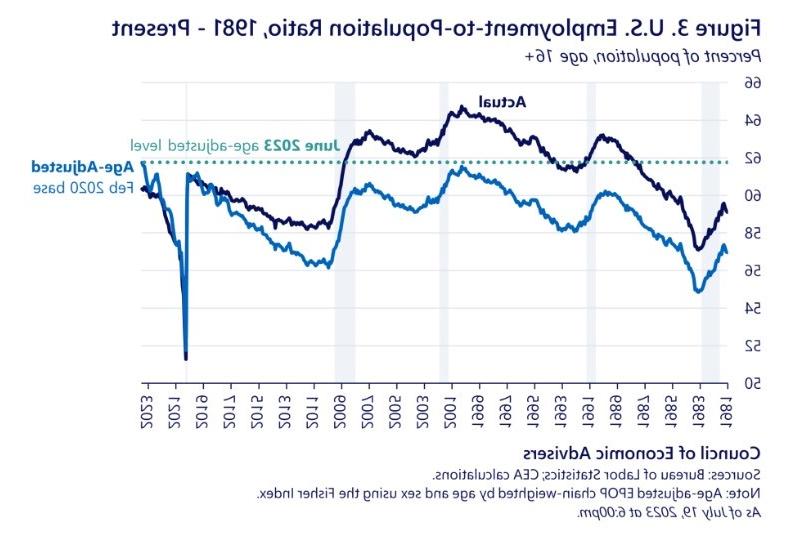

我们应该庆祝的是,这个国家有超过1.56亿人就业, the most ever (chart below).

The labor force participation rate, at 62.6%, is below the February 2020 level of 63.3%, and well off its peak of 67.2000年1月为3%,但这是因为我们的人口已经老龄化. 随着人口老龄化,劳动力的比例将会下降. Adjusted for demographics, 参与率实际上是30年来最高的(见下图).

The Fed is looking for dragons to slay. A low unemployment rate is not a problem, just as the 1.7% average inflation rate of the 2010s was not a problem.

上世纪70年代,美联储对不断上升的失业率并不满意,认为更高的通胀会降低失业率. Instead, it got both higher inflation and higher unemployment. The Fed was not satisfied with 1.7% inflation in the 2010s, 并试图用扭曲投资的零利率来制造更高的通胀. Now the Fed is not satisfied with low unemployment, fearing it pushes inflation higher, 尽管有相反的证据表明通货膨胀是由货币的供给/需求曲线引起的,而不是由失业率引起的. 我们的政策制定者似乎依赖于失业率来证明紧缩货币政策的合理性,而他们本应关注货币供应. It’s just as Mick said:

When I’m driving in my car

When a man come on the radio

He’s telling me more and more

About some useless information

Supposed to fire my imaginationUseless information is firing policymakers’ imagination. 就业和劳动参与率上升是可喜的发展, and contracting money supply is leading inflation lower. 希望通过提高失业率来遏制通货膨胀,只会导致失业, income and wealth destroyed, and the Fed’s next policy error will push inflation higher.

米克•贾格尔(Mick Jagger)没有在歌颂美联储,但他本可以.I can’t get no, I can’t get no

Print this Article

I can’t get no satisfaction, no satisfaction

No satisfaction, no satisfactionRelated Articles

-

![Negative Negative is Positive]() 22 Aug, 2016

22 Aug, 2016Negative Negative is Positive

Housing is a small part of the larger economic picture, contributing only about 5% to GDP (although includingall the ...

-

![Patience]() 17 Feb, 2015

17 Feb, 2015Patience

Interest rate cycles are long: lasting not years, but decades. Consequently, we don't have many data points for ...

-

![Erin Go Bragh!]() 17 Mar, 2015

17 Mar, 2015Erin Go Bragh!

In honor of St. 帕特里克,我想我应该和你分享这张(大部分)绿色的图表,显示了过去115年的道琼斯指数 ...

-